Why Strategic Supply Chains Underperform – And What You Can Do About It

Most supply chains aren’t broken – they’re misaligned. Despite process improvements and KPIs, many strategic relationships still suffer from missed targets, escalating costs, and wasted effort. The root cause? A failure to understand and manage what truly matters to each party.

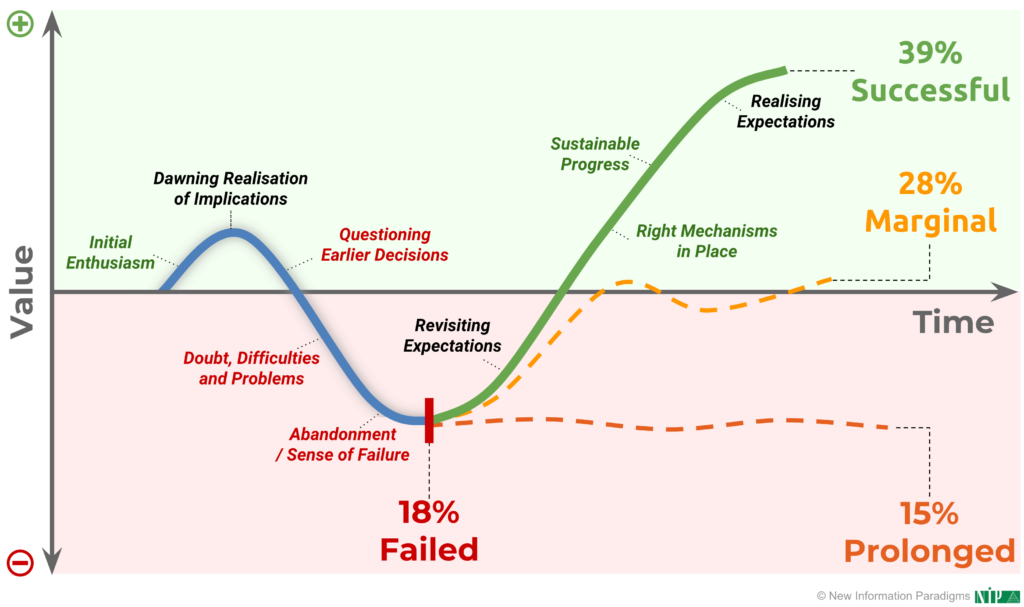

The Strategic Relationship Curve reveals a predictable pattern of underperformance driven by misalignment – of interests, expectations, and context. As complexity increases across suppliers, tiers, and partners, so does the risk of breakdown.

Success today isn’t about tighter control – it’s about deeper alignment. That means continuously surfacing, measuring, and acting on what each party values most.

This isn’t a soft skill – it’s a strategic shift. One that transforms supply chains from transactional networks into high-performance ecosystems.

The curve makes it visible. Value management makes it actionable.

Alignment, Resilience and Coherence (ARC) are the measures to harness complexity.

Supply chain success hinges on a shared foundation — common goals, trust, and clarity — that leaders instinctively grasp yet rarely have the opportunity to measure.

In a world awash with transactional data, these intangibles slip through the cracks, breeding waste and risk.

Quantify them, and you empower decisive, impactful action for resilient outcomes, ignore them and you’ll experience one or more of these situations:

Yet misalignment often goes unrecognized as the root cause of serious problems — until it’s too late to act.

Quickly gauge your alignment

The Supply Chain Alignment Diagnostic is a crucial step on the journey:

This powerful, easy-to-use diagnostic isn’t a survey — it’s a clear, structured assessment to quickly pinpoint your alignment and performance strengths, areas for improvement, and which actions will deliver the greatest impact.

Diagnostic Content

Invite your team to engage with a diagnostic which helps them easily evaluate these supply chain matters:

Your various perspectives are then gathered and reported back to you – uncovering misalignment and helping you align

ARC Value Management

Here are some examples of how the ARC Value Management Platform generates Diagnostic Solutions in Action:

Diagnose Issues

spot potential issues before they turn in to serious problems

Gauge Alignment

identify where there is and isn’t convergence of opinion

Share Strengths

capture and share best practice to improve outcomes and motivation

Diagnostics Trusted by Supply Chain Leaders

How to set up and run your diagnostic

You will be asked:

Start Your Free Alignment Diagnostic Now

🎯 See how aligned your team is

📅 Offer available until April 30, 2025

👥 Identify areas of agreement

Use the Access Code you’ve been provided

⚠ Offer expires soon. Secure your assessment today!